Latest News

Thursday, July 20, 2017

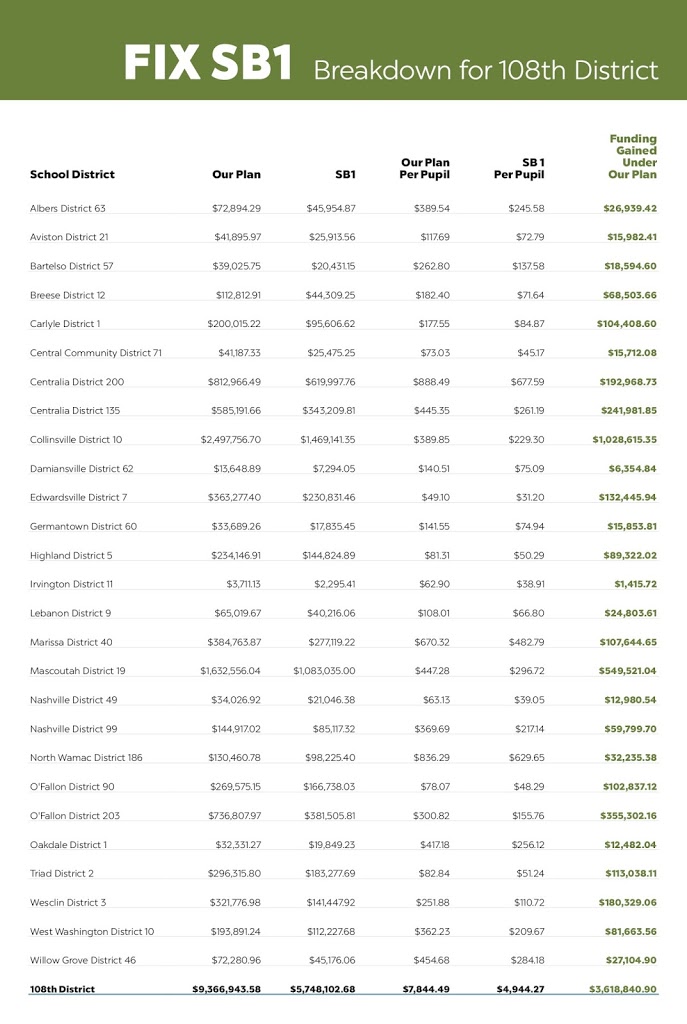

With back to school approaching in August, the Democrat controlled legislature has delayed sending Governor Bruce Rauner their school funding bill Senate Bill 1 (SB1). The Illinois General Assembly approved…

Thursday, July 6, 2017

State Representative Charlie Meier (R-Highland) released the following statement after voting against Mike Madigan’s 32 percent permanent income tax hike: “I listened to my constituents and voted against the permanentincome…